Posted on December 18 2025

How to Open a Bank Account in the UAE from India?

By , Editor

Updated December 26 2025

To open a bank account in the UAE from India, you will need to submit a valid passport, proof of residence in India, and income-related documents such as bank statements, salary letters, and an Emirates ID or a UAE visa if you plan on relocating. The first step towards opening a bank account in the UAE involves selecting a bank that offers a non-resident account, followed by arranging the required documents for submission. Additionally, you would also be required to secure a Bank Reference Letter/NOC from your Indian bank. You can submit the applications through the international services offered by your registered bank, send them in person for non-resident (NRI) bank accounts, or submit them online to UAE banks like Emirates NBD/RAKBANK.

*Are you looking to open a bank account in the UAE from India? Sign up with Y-Axis to guide you with the steps.

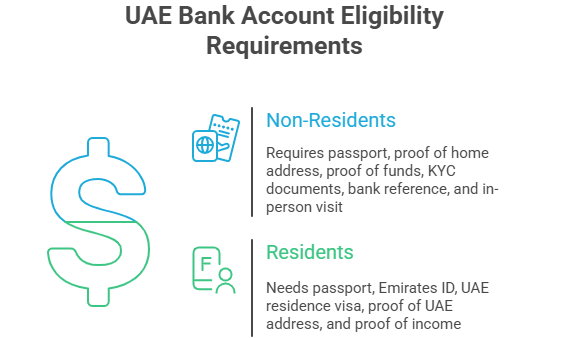

Eligibility requirements for opening a bank account in the UAE

The eligibility criteria for opening a bank account in the UAE for Indians vary depending on whether the applicant holds an Emirates ID or is a non-resident applying from India. The UAE bank accounts generally require documents such as a valid passport, proof of permanent address in the home country, and a valid KYC at the time of application submission. While it is possible to open a bank account in the UAE online, some local banks require an in-person visit for verification.

Eligibility requirements to open a bank account in the UAE without an Emirates ID (non-residents):

- An original and valid passport

- Proof of permanent address in the home country (electricity bill, tenant contract)

- Proof of funds (salary certificate, Indian bank statement).

- Original KYC documents for verification.

- Bank Reference Letter/NOC from your Indian bank.

- In-person visit for final approval.

Eligibility requirements for residents with an Emirates ID:

- An original and valid passport

- Mandatory Emirates ID

- UAE Residence visa

- Proof of address in the UAE (tenancy contract or lease agreement).

- Bank statement or salary slips as proof of sufficient income (minimum AED 5,000 for certain accounts).

*Want to open a bank account in the UAE? Avail the Y-Axis concierge banking services to help you with the process.

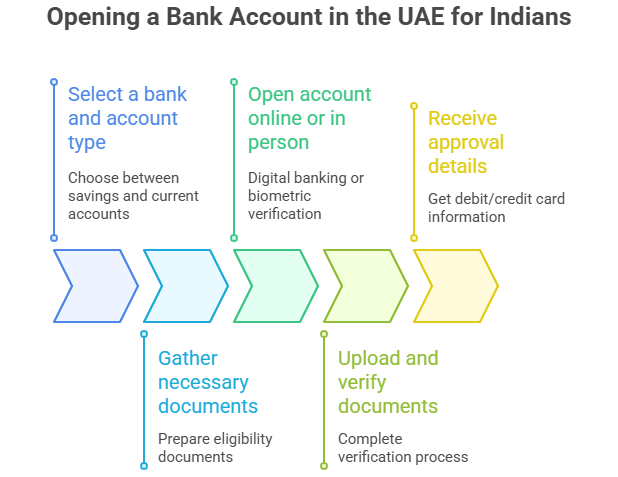

Steps to open a bank account in the UAE for Indians

The following is the step-by-step way to open a bank account in the UAE:

Step 1: Select a bank in the UAE that offers non-resident banking options and choose the correct savings account.

Step 2: Gather the necessary documents based on your eligibility, whether you are a resident or a non-resident.

Step 3: Apply online via the bank's digital banking services or visit the nearest branch for in-person biometric verification.

Step 4: Submit and verify the documents, then fund your account with the initial deposit.

Step 5: Receive account approval details, which include debit/credit card information.

Are you seeking step-by-step guidance with UAE immigration? Contact Y-Axis, the world’s No. 1 overseas immigration consultancy, for end-to-end assistance!

Tags:

open bank account in Dubai

open an account in Emirates

open bank account with UAE Pass

how to open a bank account in UAE

UAE immigration

Migrate to the UAE

work in the UAE

Bank account in the account from India

how can I open a bank account in UAE

Share

Options for you by Y-Axis

Get it on your mobile

Get News alerts

Contact Y-Axis