Posted on January 07 2026

Can I get 0% tax on my foreign source income in Dubai while working on a Freelance Visa?

By , Editor

Updated January 09 2026

Yes, you can get 0% tax on your foreign-source income in Dubai while working on a Freelance Visa, provided you meet certain conditions. The UAE does not have a personal income tax system, so income earned from overseas clients, salaries, and investments is not taxed. However, from June 2023, corporate tax applies to business income. Freelancers enjoy 0% corporate tax on annual profits up to AED 375,000, and 9% tax is charged only on profits above this limit. In many cases, foreign-source income may remain tax-free if it is not considered UAE business income, making Dubai a tax-friendly option for freelancers.

Do you want to apply for a Dubai freelance visa? Contact Y-Axis for complete guidance!

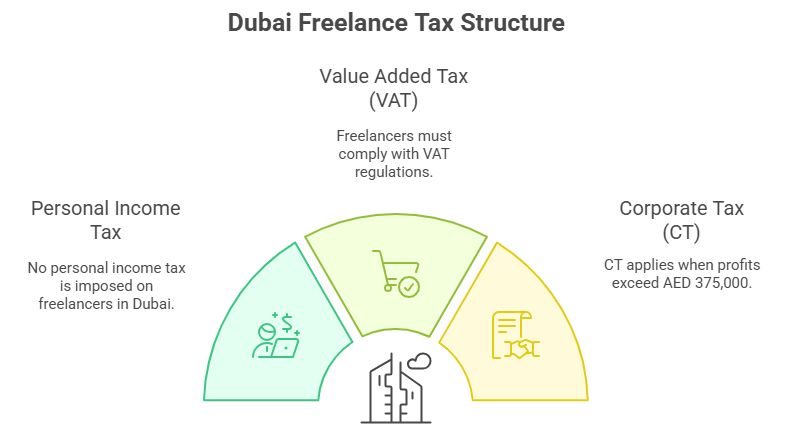

Types of taxes to pay on a Dubai freelance visa

The Dubai tax policy for salaried professionals and freelancers does not impose personal income tax charges but requires compliance with Value Added Tax (VAT). Corporate Tax (CT) is applied when freelancers cross the minimum threshold for profit (AED 375,000). Given below are the types of taxes applied while working on a Dubai freelance visa:

Personal Income Tax

- There is no personal income tax system in Dubai for freelancers and salaried individuals.

- This provides a 100% retention advantage to workers with no deductions.

Value Added Tax (VAT)

- VAT is a separate tax levied on the consumption of goods and services.

- Freelancers must register for VAT if their annual taxable turnover exceeds AED 375,000.

- A standard 5% VAT is charged for all services and goods purchased in Dubai.

- You need to generate a compliance invoice and file quarterly VAT returns.

- Dubai allows voluntary VAT registration to facilitate the later reclaiming of VAT on business expenses.

Corporate Tax (CT)

- Corporate tax is applicable for freelancers operating as ” independent businessmen” in Dubai.

- CT is charged on the total annual profit, not the cumulative turnover for the year.

- A 9% corporate tax is charged only on annual profits exceeding AED 375,000.

- Freelancers must register for Corporate Tax with the FTA, even if their profits are below the taxable threshold.

Note: Even though tax rules for freelancers in Dubai are flexible, you must also follow the tax laws of your home country. To avoid paying tax twice on the same income, you can apply for a Tax Residency Certificate (TRC). To be eligible, you must stay in Dubai for at least 183 days in a year. This helps you follow international tax rules correctly and avoid paying extra or duplicate taxes where allowed.

Do you want to work in Dubai? Sign up with Y-Axis to assist you in every step!

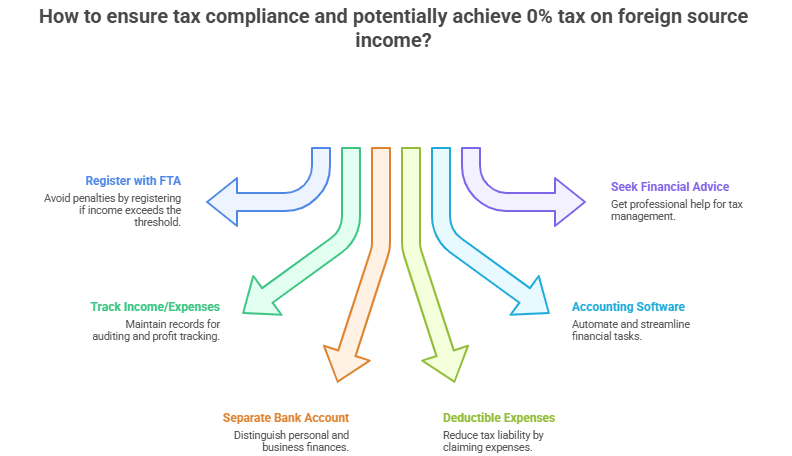

How to get 0% tax on foreign source income in Dubai?

Follow these tips to ensure tax compliance while freelancing in Dubai:

- Register with the FTA: If you expect your yearly revenue to cross AED 3,000,000, register with the Federal Tax Authority (FTA) on time to avoid penalties.

- Track your income and expenses: Keep clear records of all money you earn and spend. Save bank statements and invoices for at least 5 years in case of audits.

- Use a separate bank account: Open a dedicated bank account for your freelance income so business and personal expenses don’t get mixed.

- Claim allowed expenses: Reduce your tax by claiming business expenses like rent, software costs, internet, and insurance.

- Use accounting software: Accounting tools help you create invoices, track expenses, and stay compliant easily.

- Get professional advice: Speak with a tax advisor to manage taxes correctly and improve your profits.

*Are you looking for step-by-step assistance with UAE immigration? Contact Y-Axis, the world’s No. 1 overseas immigration consultancy, for end-to-end assistance!

FAQs

Can I get 0% tax on foreign source income in Dubai on a freelance visa?

Yes, Dubai generally allows 0% personal income tax on foreign source income while you work on a freelance visa, as the UAE does not levy personal income tax on individuals. Income earned from overseas clients, foreign bank accounts, or international platforms is not taxed locally. However, you must ensure your freelance activity is legally licensed, income is reported where required, and you comply with economic substance and corporate tax rules if applicable. Personal tax exemption does not remove obligations in your home country, where foreign income may still be taxable.

Does the UAE tax freelancers on personal income?

The UAE does not impose personal income tax on freelancers, including those holding a freelance visa in Dubai. This means your earnings, whether local or foreign sourced, are not taxed at the individual level. Freelancers benefit from this tax-friendly structure, making Dubai attractive for independent professionals. However, you must hold a valid freelance permit and residence visa. While personal income is tax-free, regulatory compliance, license renewal, and banking transparency are essential. Tax rules may differ if your activities fall under corporate tax thresholds or business structures.

Is foreign source income completely tax free in Dubai?

Foreign source income is generally tax free in Dubai for individuals, including freelancers. The UAE does not tax income earned outside the country, such as payments from international clients or foreign employers. As long as income is received personally and not through a taxable corporate structure, no local income tax applies. However, this does not override tax obligations in your country of citizenship or tax residence elsewhere. Double taxation treaties may apply. Proper documentation and clarity on income source help ensure compliance.

Does a Dubai freelance visa fall under UAE corporate tax?

A Dubai freelance visa does not automatically fall under UAE corporate tax. Corporate tax applies to businesses earning above the defined threshold and operating as legal entities. Most freelancers operating as individuals are exempt from corporate tax on personal income. However, if freelance income is structured as a business or exceeds limits requiring registration, corporate tax obligations may apply. Understanding whether your activity qualifies as personal professional income or business income is important. Consulting a tax advisor ensures compliance with evolving UAE tax regulations.

Do I need to declare foreign income in Dubai?

Currently, individuals in Dubai do not need to declare foreign source income for personal tax purposes, as there is no personal income tax regime. Freelancers are not required to file income tax returns locally. However, banks may request income details for compliance, and license authorities may review activity consistency. While Dubai does not tax income, you may still need to declare foreign income in your home country. Maintaining transparent records helps avoid compliance issues across jurisdictions.

Can my home country still tax my foreign income?

Yes, your home country may still tax your foreign income even if Dubai does not. Many countries tax citizens or residents on worldwide income. Moving to Dubai does not automatically remove tax residency elsewhere. To benefit fully, you may need to change tax residency status and meet exit requirements. Double taxation avoidance agreements between the UAE and your home country may help reduce liability. Always verify residency rules and reporting obligations to avoid penalties or unexpected tax demands.

Does VAT apply to freelancers earning foreign income?

VAT in the UAE generally applies to taxable supplies made within the country. Freelancers earning income from foreign clients may be outside the scope of UAE VAT, depending on service type and client location. However, if you exceed the VAT registration threshold, registration may be mandatory. VAT treatment varies for zero-rated and exempt services. Freelancers must understand whether their services attract VAT. Consulting a VAT expert ensures correct treatment and avoids penalties for incorrect registration or invoicing practices.

Is a tax residency certificate needed for 0% tax benefits?

A tax residency certificate is not required to enjoy 0% personal income tax in Dubai, but it can be useful. It helps prove UAE tax residency to foreign tax authorities and banks. This certificate is often needed to claim benefits under double taxation treaties. Freelancers who wish to demonstrate non-residency in their home country may find it helpful. Meeting residency criteria such as minimum stay is required. The certificate strengthens your position in cross-border tax matters.

Can freelancing income trigger audits or scrutiny in Dubai?

While Dubai does not tax personal income, freelancing income can still face regulatory scrutiny. Authorities may review whether your activities align with your freelance license. Banks may conduct compliance checks under anti-money laundering regulations. Large or irregular foreign transfers can attract questions. This is not taxation but regulatory oversight. Maintaining proper invoices, contracts, and transaction records helps avoid issues. Transparent operations ensure smooth banking, license renewals, and long-term residency stability in Dubai.

Is Dubai a safe tax base for long-term freelancers?

Dubai is considered a safe and stable tax base for long-term freelancers due to its 0% personal income tax policy. Clear licensing frameworks, strong banking systems, and residency options support independent professionals. However, global tax transparency is increasing. Freelancers must manage international compliance, residency rules, and evolving corporate tax laws. Dubai remains attractive when structured correctly. Long-term success depends on proper licensing, understanding cross-border tax exposure, and maintaining clean financial and legal records.

Tags:

freelance visa in Dubai

Dubai freelance visa cost India

Dubai freelance visa from India

Freelance visa Dubai activities

Freelance visa Dubai cost

Dubai freelance visa benefits

How to get freelancer visa in Dubai

Freelance visa in Dubai requirements

Share

Options for you by Y-Axis

Get it on your mobile

Get News alerts

Contact Y-Axis