Posted on January 08 2026

Can I get 0% tax on Global Invoicing, if I set up a Business in UAE?

By , Editor

Updated January 10 2026

Yes, you can qualify for 0% corporate tax on global invoicing if you set up your business in a UAE Free Zone and meet the conditions to become a Qualifying Free Zone Person (QFZP) under UAE Corporate Tax law. The UAE introduced Federal Corporate Tax in June 2023. Under this law, Free Zone companies can continue to enjoy 0% corporate tax on qualifying income, mainly income earned from foreign clients or other Free Zone entities, as long as they meet all compliance rules. It is important to note that 0% tax on global invoicing is not automatic. Businesses must strictly follow UAE tax rules, Free Zone regulations, and reporting requirements to maintain this benefit.

*Want to apply for a UAE Business visa from India? Contact Y-Axis to assist you in every step.

How to qualify for 0% Tax on Global Invoicing in a Free Zone?

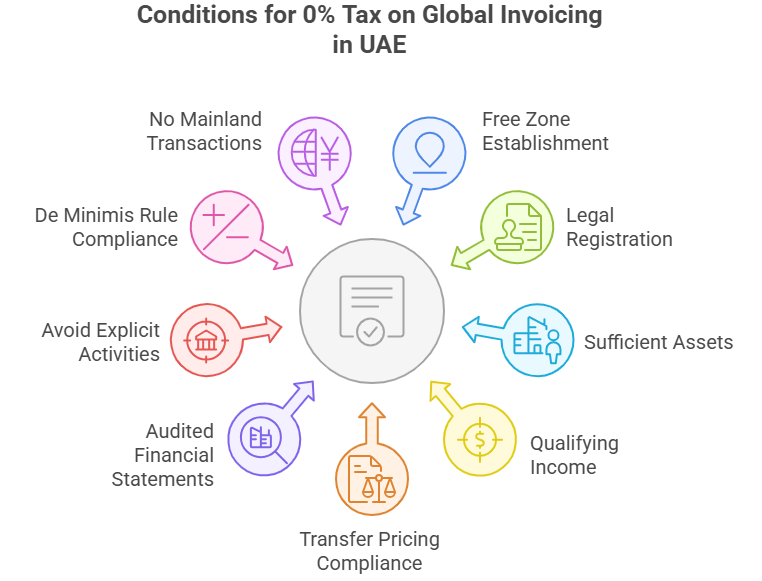

Global business owners settled in the UAE benefit from a 0% corporate tax rate for global invoicing (foreign-sourced), provided they qualify as a QFZP. The following are the conditions to qualify for 0% tax on global invoicing from the UAE:

- Established in a UAE free zone: The business must consistently operate from designated free zones in the UAE.

- Legal registration: The corporation must have legal registration to operate in the UAE free zone. Standard rates are applicable to both individual business owners and freelancers with an annual income exceeding AED 1 million.

- Functional with sufficient assets: The organisation must have a physical presence, such as an office, qualified employees, and physical assets, with core income-generating activities in the UAE tax-free zone. Virtual companies are not eligible for the 0% tax benefits.

- Qualifying income: Income must be generated from "Specific Qualifying Activities" which include transactions with organisations/entities outside the UAE or within the free zone.

- Compliance with Transfer Pricing rules: All transactions between the two parties must be in compliance with the international arm's length principle, supported by relevant documentation.

- Maintain documents for auditing: Financial statements must be audited periodically, adhering to the International Financial Reporting Standards (IFRS), regardless of the annual revenue generated.

- Avoid explicit activities: Businesses should strictly avoid activities that are considered explicit to receive preferential tax treatment. This includes banking, general financial support, and specific real estate engagements.

- De Minimis Rule complaint: The company should be compliant with the De Minimis Rule, which specifies that if revenue generated from any excluded activities or mainland transactions should not exceed AED 5 million or 5% of the total business revenue.

- Engage in no mainland transactions: No direct business interactions should be maintained with the UAE mainland, although certain passive transactions, such as rentals through an approved mainland distributor, are permitted.

*Are you looking for step-by-step assistance with UAE immigration? Contact Y-Axis, the world's No. 1 overseas immigration consultancy, for end-to-end assistance!

FAQs

Can I get 0% tax on global invoicing if I set up a business in the UAE?

Yes, it is possible to achieve 0% tax on global invoicing in the UAE, but only under specific conditions. The UAE offers a highly favorable tax environment with 0% personal income tax and potential corporate tax exemptions. If your business qualifies as a Free Zone Person and meets all compliance requirements, income earned from overseas clients may be taxed at 0%. However, this depends on the business activity, licensing authority, and whether the income is considered qualifying income under UAE Corporate Tax Law.

What is global invoicing and how does it work in the UAE?

Global invoicing refers to issuing invoices to international clients for services or goods provided across borders. In the UAE, businesses can legally invoice global clients through mainland or free zone entities. The tax treatment depends on where the business is registered, where clients are located, and whether the income qualifies as foreign-sourced. Proper documentation, contracts, and substance in the UAE are essential to support tax benefits and ensure compliance with UAE corporate tax regulations.

Does the UAE charge tax on foreign-source income?

The UAE generally does not tax foreign-source income for individuals, and businesses may benefit from exemptions depending on their structure. Free zone companies earning income from outside the UAE may qualify for 0% corporate tax if they meet the definition of qualifying income. Mainland companies, however, are subject to 9% corporate tax on taxable profits exceeding the threshold. Correct classification of income and adherence to transfer pricing and substance rules are crucial to maintaining tax efficiency.

Is a Free Zone company better than a mainland company for 0% tax?

For global invoicing, a free zone company is often more tax-efficient than a mainland company. Many UAE free zones offer 0% corporate tax on qualifying income, especially when clients are located outside the UAE. Mainland companies are subject to standard corporate tax rules and may not qualify for exemptions. However, free zone businesses must avoid conducting restricted mainland activities to retain tax benefits, making proper structuring and activity selection essential.

What is qualifying income under UAE corporate tax law?

Qualifying income generally includes income earned from transactions with foreign clients or other free zone entities, provided the business complies with UAE regulations. It excludes income generated from mainland UAE clients unless specific conditions are met. To qualify for 0% tax, businesses must maintain adequate economic substance, comply with transfer pricing rules, and file annual tax returns. Understanding what qualifies is critical to avoiding unexpected tax liabilities.

Do I need to pay VAT on global invoicing in the UAE?

VAT treatment depends on the nature of the service and the location of the client. Many services invoiced to non-UAE clients are zero-rated or outside the scope of UAE VAT, resulting in no VAT charged. However, some services may still attract VAT depending on use and place of supply rules. VAT registration may still be mandatory if turnover exceeds the threshold, even if VAT payable is zero.

Can freelancers or consultants get 0% tax on global income in the UAE?

Yes, freelancers and consultants can benefit from 0% personal income tax in the UAE. If operating through a freelance permit or sole establishment, personal income remains untaxed. However, once corporate tax applies, income structure matters. Freelancers earning through a registered business may be subject to corporate tax unless operating within a qualifying free zone or meeting exemption criteria. Professional advice helps optimize the setup.

Are there substance requirements to maintain 0% tax status?

Yes, economic substance is mandatory for businesses claiming tax benefits in the UAE. This includes having an office address, conducting core income-generating activities locally, and maintaining proper staff or management presence where required. Free zone companies must demonstrate genuine operations to avoid reclassification and penalties. Lack of substance can result in loss of 0% tax benefits and exposure to corporate tax.

Do double taxation avoidance agreements help with global invoicing?

The UAE has an extensive network of double taxation avoidance agreements with many countries. These treaties help prevent income from being taxed twice and can reduce withholding taxes on international payments. While they do not automatically guarantee 0% tax, they significantly improve tax efficiency for global invoicing businesses. Correct treaty application and documentation are necessary to claim benefits legally.

Is professional tax advice necessary before setting up a UAE business?

Yes, professional tax and legal advice is strongly recommended before setting up a UAE business for global invoicing. Corporate tax rules, free zone regulations, VAT laws, and international tax considerations are complex and evolving. A tailored structure ensures compliance, minimizes risk, and maximizes tax efficiency. Proper planning from the start helps businesses legitimately achieve low or 0% tax outcomes while avoiding penalties and future restructuring costs.

Tags:

set up a business in the UAE

UAE business visa

UAE immigration

UAE corporate tax

UAE corporate tax rate

work in the UAE

0% Tax on Global Invoicing

Qualifying Free Zone Person (QFZP)

UAE tax free foreign income

UAE income tax rate

Share

Options for you by Y-Axis

Get it on your mobile

Get News alerts

Contact Y-Axis